TIME IS RUNNING OUT! SECURE YOUR SECTION 179 SAVINGS BEFORE YEAR-END

The end of the year is fast approaching — and that means it’s time to take advantage of one of the most powerful tax incentives available to businesses: Section 179.

If you’ve been considering new or used equipment, trucks, or attachments for your fleet, now is the time to act. Section 179 allows you to deduct the full purchase price of qualifying equipment — up to a specific limit — in the year you place it into service. This year, the program offers even more flexibility and higher deduction limits, making it one of the smartest financial decisions your business can make before December 31, 2025.

Don’t Miss Out on 2025 Section 179 Savings for Trucks and Equipment

Section 179 of the Internal Revenue Code empowers businesses to deduct the full purchase price of qualifying equipment and software in the same tax year they’re put into service. Instead of stretching depreciation across several years, you can claim the entire cost upfront—dramatically improving your cash flow and creating immediate tax benefits.

What Is Section 179?

Section 179 of the IRS tax code was designed to help businesses invest in themselves by allowing them to deduct the full cost of qualifying equipment purchases in the same year they’re placed in service, rather than depreciating them over time.

It’s essentially an instant tax break for equipment that improves your business operations — perfect for contractors, municipalities, and trucking companies looking to upgrade or expand their fleets before the year ends.

For 2025, businesses can deduct up to $2,500,000 in qualifying purchases. This represents the total amount you can write off immediately, provided your equipment meets these key criteria:

- Placed in service during the 2025 tax year

- Used for business purposes more than 50% of the time

- Qualifies under IRS guidelines

Spending Cap and Phase-Out Rules

The Section 179 deduction begins to phase out when your equipment purchases exceed $4,000,000:

- Dollar-for-dollar reduction above $4,000,000:

- Complete phase-out at $6,500,000

- Additional purchases may still qualify for bonus depreciation

That means if you buy or finance qualifying equipment and place it in service by December 31, 2025, you can deduct the full cost this tax year.

What Equipment Qualifies Under Section 179?

Most business-use equipment purchased or financed during the tax year qualifies for the Section 179 deduction.

At Tracey Road Equipment, qualifying purchases may include:

New or used heavy equipment — excavators, wheel loaders, dozers, compact track loaders, and skid steers

Commercial trucks and vocational vehicles — Freightliner, Western Star, or other business-use trucks

Trailers and attachments — Felling, Manac, or other commercial hauling units

Municipal equipment — snowplows, spreaders, and street maintenance vehicles

(Personal-use vehicles or leased units not used for business generally do not qualify.)

Why Section 179 Is Especially Valuable in 2025

The 2025 Section 179 limits are higher than ever, meaning businesses can write off more — and invest more confidently.

Here’s why it’s worth acting now:

Increased Deduction Limit: The deduction has been adjusted for inflation, allowing even greater upfront savings.

Bonus Depreciation Still Available: After you hit the Section 179 cap, you can still depreciate remaining costs under bonus depreciation.

Immediate Cash Flow Benefits: Deducting the full amount this year reduces your taxable income — freeing up capital for other business needs.

Applies to New & Used Equipment: Qualifying used purchases still count, offering flexibility for companies buying pre-owned assets.

Deadline Approaching: Equipment must be purchased and placed into service by December 31, 2025 to qualify.

For many contractors, this can mean tens of thousands of dollars in savings — or more — when investing in fleet upgrades or replacements.

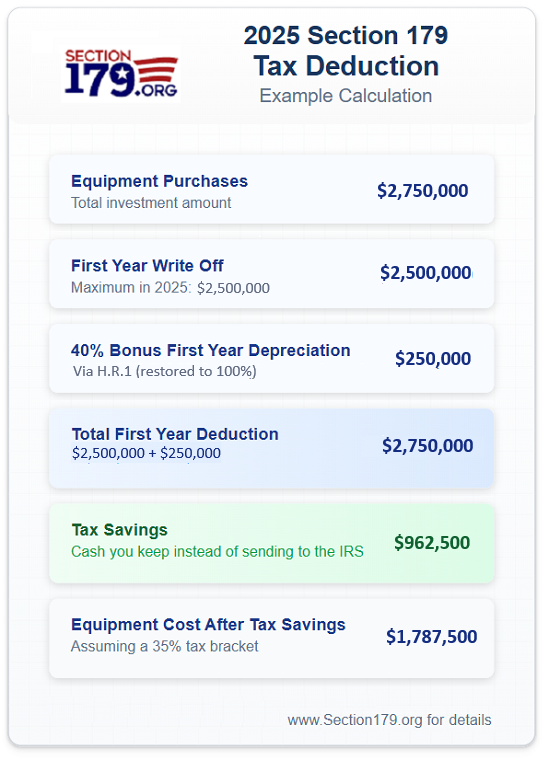

Example Savings with Section 179

Let’s say your business purchases $500,000 in qualifying equipment in 2025.

Without Section 179:

You’d depreciate the equipment over several years, deducting only a portion annually.

With Section 179:

You can deduct the entire $500,000 this year, potentially saving up to $175,000 or more in federal taxes (depending on your tax bracket).

That’s money you can reinvest into your business right away — whether for additional equipment, hiring, or growth.

How to Take Advantage of Section 179

Purchase qualifying equipment — New or used, from Tracey Road Equipment.

Place it into service before December 31, 2025 (it must be operational by year-end).

Consult your tax professional to confirm eligibility and file your deduction properly.

The process is simple, but timing is everything — waiting until January means missing out on this year’s deduction.

Partner with Tracey Road Equipment

At Tracey Road Equipment, we help contractors, municipalities, and fleet operators get the most out of their investments. Our sales and financing teams can walk you through eligible equipment, purchase options, and delivery timelines to ensure your new machine or truck qualifies before the December 31, 2025 deadline.

We’re here to help you maximize your Section 179 benefits, reduce your tax burden, and keep your operation productive year-round.